Scammers are constantly finding new ways to deceive people, using various schemes to exploit vulnerabilities in our daily lives. These fraudsters often employ a range of tactics through text messages, phone calls, emails, or social media platforms, making it increasingly difficult for individuals to identify and avoid their traps. With the rise of technology and the internet, scammers can easily reach potential victims, creating convincing impersonations of legitimate organizations and making their offers seem appealing. Understanding the common tactics used by scammers is essential for everyone, as it can help individuals protect themselves and their personal information from being compromised. By being aware of these tactics, individuals can take proactive measures to safeguard their assets and avoid falling prey to these malicious schemes. Here are some of the most common tactics they use to lure their victims:

Unrealistic Rewards

One of the most prevalent tactics employed by scammers is the promise of unrealistic rewards. Scammers often send messages congratulating individuals for winning a contest or raffle they never entered. These messages may claim that the recipient has won a significant cash prize, luxury vacation, or high-value merchandise. To claim their winnings, victims are often instructed to provide personal information or pay a nominal fee. It’s crucial to remember that if an offer seems too good to be true, it most likely is. Legitimate contests typically require participants to enter, and reputable organizations do not ask for payment to claim a prize.

High-Paying Job Offers

Another common scam involves job offers that promise exorbitant salaries for minimal effort. Scammers may advertise these positions on job boards, social media, or even through direct emails. The job descriptions may sound enticing, with promises of flexible hours, remote work, and high compensation. However, these offers often come with hidden traps. Scammers may request an application fee, background check fee, or even ask for personal information under the guise of a job application. For any job seeker, an upfront fee is a significant red flag, as legitimate employers do not charge candidates to apply for positions.

Low-Risk, High-Return Investments

Investment scams are another tactic scammers use to deceive individuals. Some scammers promise high returns with little to no risk in fake investment schemes. They may advertise these schemes through online ads, social media, or email, enticing potential victims with claims of guaranteed profits. To make these offers appear credible, scammers often use fabricated testimonials, fake endorsements from well-known executives, or even hijack legitimate websites to post fake interviews or articles. These schemes can take various forms, including Ponzi schemes, cryptocurrency scams, or bogus real estate investments. It’s essential for individuals to conduct thorough research before investing their money and to be wary of offers that seem too good to be true.

Threats and Scare Tactics

In contrast to the enticing offers mentioned above, some scammers rely on fear tactics to manipulate their targets. These scammers may impersonate bank representatives or government officials and use scare tactics to pressure their victims into making hasty decisions. For example, they may contact individuals claiming they’ve noticed suspicious activity on their bank accounts, stating that the account has been locked for security reasons. To “unlock” the account, victims are instructed to click on a link that leads to a fake website and enter their login details. This technique not only aims to steal sensitive information but also creates a sense of urgency that can cloud the victim’s judgment.

Common Traits of Scammers

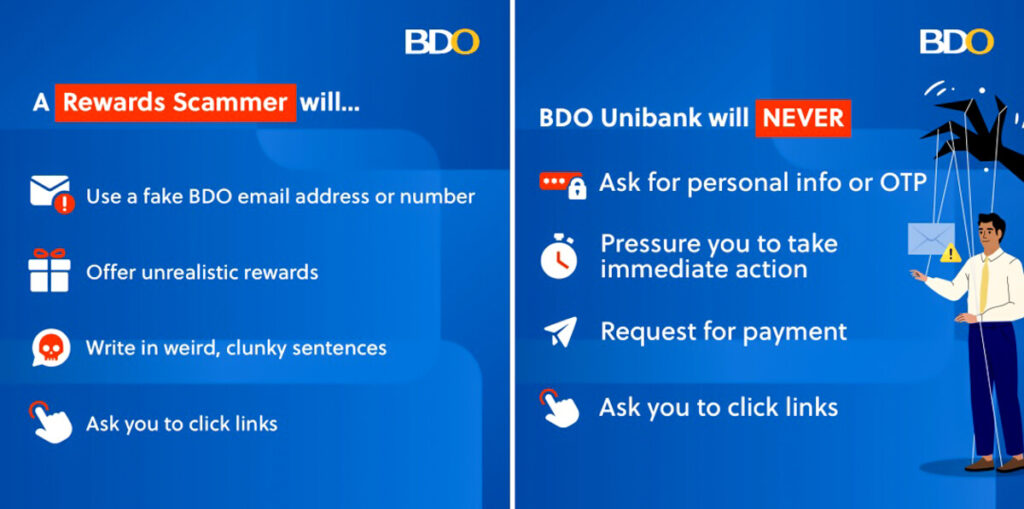

Regardless of the specific tactic employed, scammers often exhibit several common behaviors that can help individuals identify fraudulent schemes:

- Too Good to Be True Offers: Scammers make offers that are unrealistic or extraordinarily generous, aiming to attract victims with the promise of easy gains.

- Pressure Tactics: Scammers exert pressure on their victims to act quickly, creating a sense of urgency that can lead to poor decision-making.

- Requests for Personal Information: Scammers often ask for sensitive personal information, such as Social Security numbers, bank account details, or passwords.

- Suspicious Links: They frequently send links to websites that appear legitimate but are designed to steal information.

- Poor Grammar and Strange Phrasing: Many scam messages contain grammatical errors or awkward language, which can be a telltale sign of a fraudulent attempt.

To protect the public from falling victim to these scams, BDO Unibank emphasizes that it will never:

- Ask for personal information or a One-Time PIN (OTP);

- Request users to click on links;

- Pressure anyone to take immediate action;

- Ask for payments.

BDO reminds everyone to stay informed about the different types of scams and offers tips on protecting online banking accounts. It’s crucial for individuals to regularly monitor their bank statements, be cautious of unsolicited communications, and verify the authenticity of any offers or requests for information. For more information on safeguarding against scams, visit www.bdo.com.ph. #BDOStopScam