Today, GoTyme Bank, Philippine interbank ATM and online banking network BancNet, and Visa, one of the worldŌĆÖs leaders in digital payments, formed a strategic partnership to address the need for convenient and accessible banking and digital payment solutions in the Philippines.

Cashless transactions have become the norm as a way to stay safe during the pandemic. The 2021 Consumer Payment Attitudes study conducted by Visa, found 14% of the respondents used contactless cards to pay for their transactions for the first time in 2020 while 12% of the respondents, led by the Gen Z and Gen Y age groups, said they will be less likely to use cash after the current health crisis. This means that cashless payment forms such as cards and e-wallet, as well as digital bank platforms will play a bigger role in the transition to a cashless Philippine society.

VisaŌĆÖs worldwide reach and expertise in digital payments, synergizing with BancNetŌĆÖs extensive nationwide and offshore coverage, together with GoTyme Bank and the Gokongwei brandŌĆÖs reputation, technology and understanding of the Philippines market, will offer consumers high quality banking to every Filipino, and an exciting and rewarding digital payment and money movement experience.

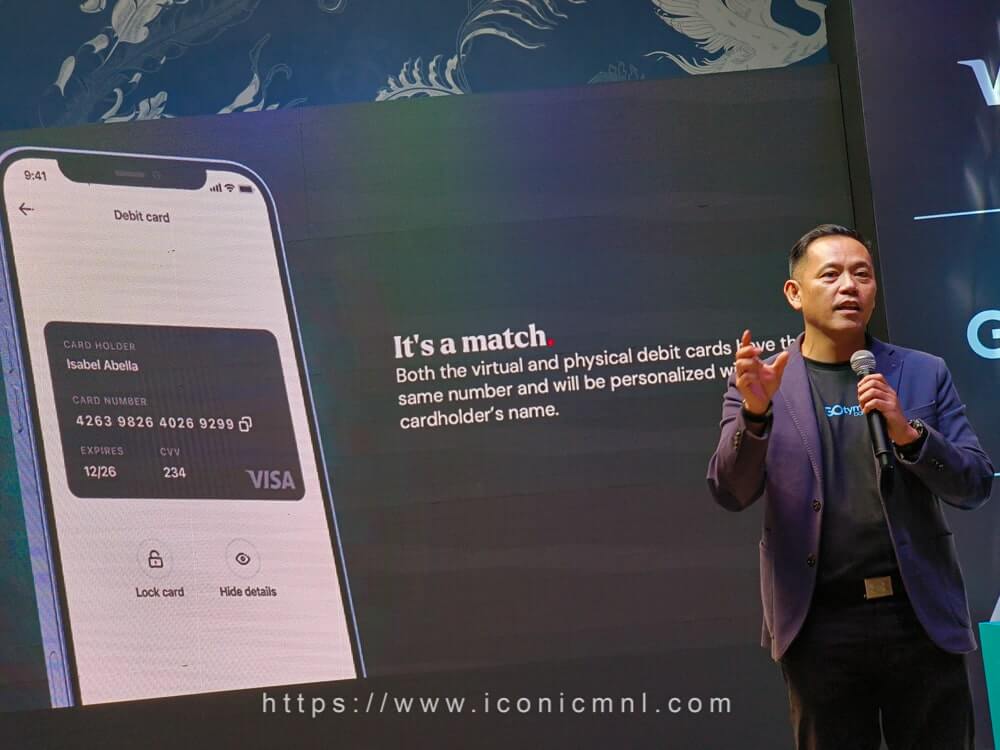

This partnership launch coincided with the introduction of the GoTyme Visa ATM Debit Card that will be given out for free to all GoTyme Bank Account holders. This high-quality card will allow everyone to enjoy the benefits of Visa for transactions worldwide including withdrawals from any ATM when traveling outside of the country.

Powered by BancNet, which is the PhilippinesŌĆÖ single ATM switch operator, the multi-bank, multi-channel electronic payments network will enable GoTyme cardholders to transact not only at automated teller machines (ATM) but also at point-of-sale (P.O.S.) terminals, the Internet and mobile phones to access a wide range of services through the different channels, including real-time fund transfers and payment of purchases by direct debit to account through InstaPay.

The virtual and physical cards will have the same number and will be personalized with the cardholderŌĆÖs name. BancNet CEO Emmie Reyes says, ŌĆ£With this partnership, GoTyme will have access to the cutting-edge switch infrastructure that BancNet operates and which enables secure and reliable money transfers to other banks and e-wallets in real time, at any time. GoTyme customers will also be able to transact at over 24,000 ATMs and more than 480,000 POS terminals nationwide.ŌĆØ

Jeff Navarro, VisaŌĆÖs Country Manager for the Philippines and Guam stated, ŌĆ£I am excited to launch this partnership with GoTyme and BancNet. Visa has always been committed to making the digital payment experience seamless, secure, and accessible to all. VisaŌĆÖs Consumer Payment Attitudes Study showed that more Filipinos are trying cashless modes of payment, and it is our collective goal to keep this momentum going. Together, we hope to address some of the barriers preventing Filipinos from embracing cashless payments, helping to drive greater financial inclusion in the country.ŌĆØ

Initially, consumers who download the GoTyme app will be able to generate a Visa-powered virtual card for free that they can use to make digital payments and other related transactions, with more exciting solutions and benefits in the pipeline. This easy process for onboarding will offer safer, better and varied options for their banking and payments needs including instant access to banking and payments platforms through the Visa debit card. The personalized cards will be issued in real time through GoTyme Bank. These can be used for ecommerce and the physical card can also be used for transactions here and abroad.

ŌĆ£We are building on the success of Tyme in South Africa, which became the fastest Visa issuer in the continent, and we are bringing it to the Philippines with GoTyme Bank. This partnership aligns with our shared vision and commitment to uplift the Philippines’ digital economy,ŌĆØ says GoTyme Bank President and CEO Nathaniel Clarke.

ŌĆ£This partnership is designed to benefit all Filipinos by providing access to high quality banking and making digital and cashless transactions as seamless, secure, and convenient as possible. Through this, we hope to encourage more Filipinos to embrace digital payments as the way forward toward a cashless society,ŌĆØ says GoTyme Bank Co-CEO Albert Tinio.

ŌĆ£This partnership is designed to benefit all Filipinos by providing access to high-quality banking and making digital and cashless transactions as seamless, secure, and convenient as possible. Through this, we hope to encourage more Filipinos to embrace digital payments as the way forward toward a cashless society,ŌĆØ says GoTyme Bank Co-CEO Albert Tinio.